Our Global Listed Infrastructure Collective Investment Trust with SEI utilizes the same underlying investment strategy as our institutional product. For more information or offering documents please contact Sarah Honold at [email protected].

Bringing our heritage into the future

Our infrastructure strategies invest in companies that are essential to the economy, such as communications, utilities, transportation, and energy. These stocks represent real, long-lived assets that are necessary for society to thrive and grow. They include companies that own or have operational control of power transmission, railroads, pipelines, airports, and cell towers.

We believe infrastructure companies can provide a solid foundation to a portfolio by potentially offering:

Strong Cash Flows

Infrastructure typically experiences inelastic price demand for products and services, and is protected by high barriers to entry.

Inflation Protection

Many companies tend to have long-term contracts or regulatory agreements that allow for price escalation.

Downside Protection

Essential services companies have the ability to perform well in various economic environments.

Diversification Benefits

Broad diversification offered through a range of subsectors and geographies which tend to have little overlap with global equities.

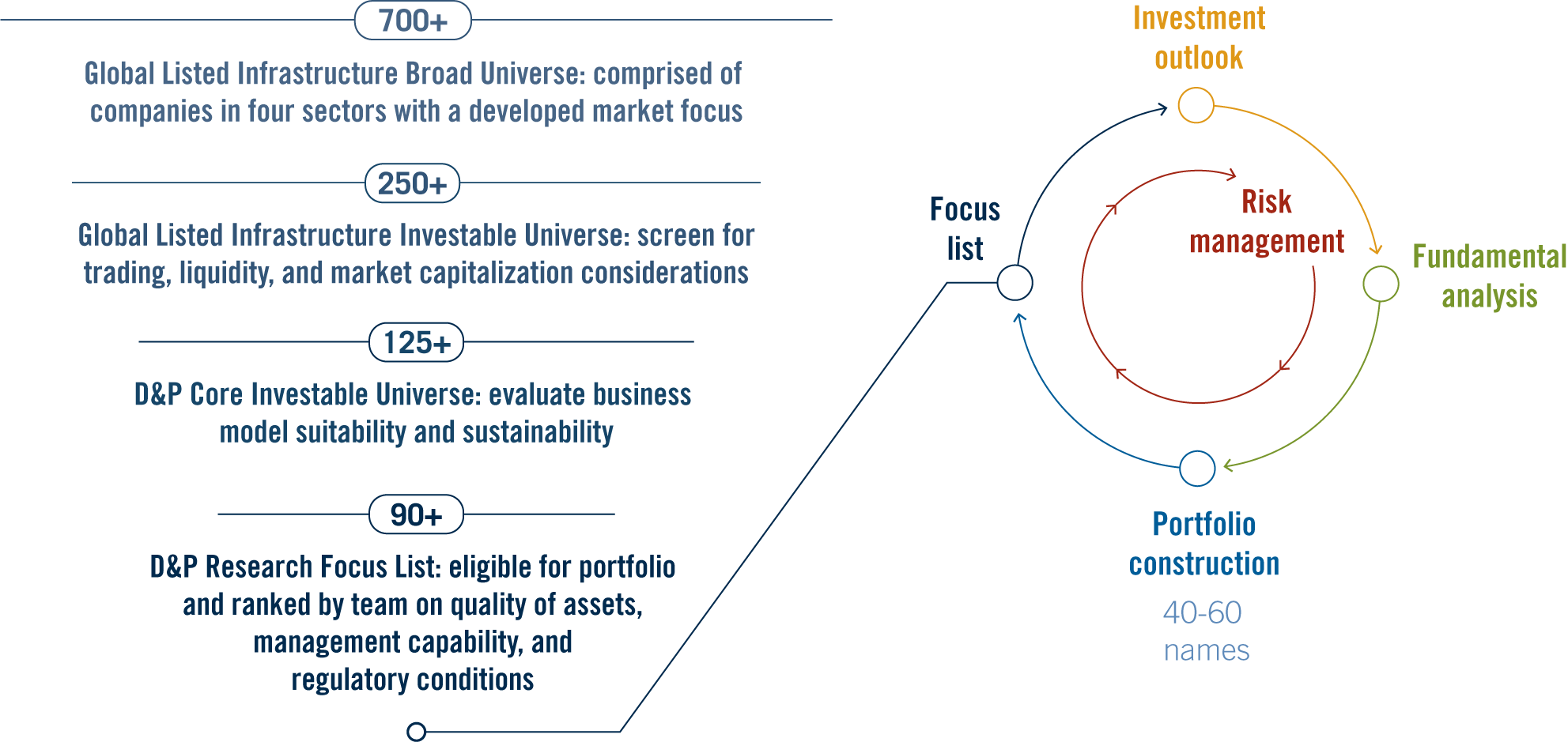

Our Investment Process